Malaysians Investing In UK Property

Wednesday, 27 May 2020

Friday, 15 May 2020

A very fruitful visit to the UK

One of our investors, Daniel visited the UK last year to visit one of his properties which we helped to source, it was just about to complete so it was a very timely visit.

He also visited our development site in Croydon for Ria Apartments.

So very glad to have him onboard with another collaboration project in Edinburgh, Slateford House.

He also visited our development site in Croydon for Ria Apartments.

So very glad to have him onboard with another collaboration project in Edinburgh, Slateford House.

Thursday, 14 May 2020

England Housing Market Is Released From Lockdown

300,000 resi transactions UK wide with sales agreed ready to be progressed and 65,000 valuations ready to be carried out now that estate agents and surveyors are allowed to proceed, with suitable Personal Protection and Social distancing rules observed.

Friday, 1 May 2020

New Stamp Duty Land Tax Rates for Non-UK Residents

Announcement of New Stamp Duty Land Tax

On 11th March 2020, Chancellor Rishi Sunak announced in the Budget that SDLT for overseas buyers will include an additional 2% stamp duty surcharge for purchases from 1 April 2021 if they buy a residential property in England or Northern Ireland.

Currently, there is no difference in stamp duty surcharge between UK residents and non-UK residents.

What triggered the proposal of the Non-UK Resident Stamp Duty Surcharge?

The Government hoped that the new stamp duty surcharge could take some heat out of the London property market where foreign investment is high. This in turn could help control house price inflation with the aim of making housing more affordable for UK residents.

In 2016, to control increase in house prices, which they believed was due to investor demand, the Government had announced a surcharge of additional 3% SDLT for people buying their 2nd residential property and upwards. The location of the 1st property is irrelevant, so unless that buyer does not own any property anywhere else in the world, the oversea buyer will have to pay a total of an additional of 5% Stamp Duty Land Tax.

Possible blind-spots

1. Property purchase in Scotland or Wales may be exempted from this surcharge, so it may be a good option to purchase in these areas.

2. Purchasing the property with a UK-Registered Company, because this means the entity buying the property will not be an oversea buyer, but rather a local company.

3. Buying off-plan and then flipping the property before completion of sale to a UK resident, because SDLT is only payable upon completion of a purchase. When a property is bought off plan, there is a long period between the exchange of contracts (signing the SNP in Malaysian terms), and completions (when the entire purchase price has been paid). So if the oversea investor sells off the property before it is completed then it is left to the ultimate purchaser to complete the sale and pay the SDLT.

To assist you in calculating your SDLT, please go to the following link for the stamp duty calculator:

https://www.stampdutycalculator.org.uk/

On 11th March 2020, Chancellor Rishi Sunak announced in the Budget that SDLT for overseas buyers will include an additional 2% stamp duty surcharge for purchases from 1 April 2021 if they buy a residential property in England or Northern Ireland.

Currently, there is no difference in stamp duty surcharge between UK residents and non-UK residents.

What triggered the proposal of the Non-UK Resident Stamp Duty Surcharge?

The Government hoped that the new stamp duty surcharge could take some heat out of the London property market where foreign investment is high. This in turn could help control house price inflation with the aim of making housing more affordable for UK residents.

In 2016, to control increase in house prices, which they believed was due to investor demand, the Government had announced a surcharge of additional 3% SDLT for people buying their 2nd residential property and upwards. The location of the 1st property is irrelevant, so unless that buyer does not own any property anywhere else in the world, the oversea buyer will have to pay a total of an additional of 5% Stamp Duty Land Tax.

Possible blind-spots

1. Property purchase in Scotland or Wales may be exempted from this surcharge, so it may be a good option to purchase in these areas.

2. Purchasing the property with a UK-Registered Company, because this means the entity buying the property will not be an oversea buyer, but rather a local company.

3. Buying off-plan and then flipping the property before completion of sale to a UK resident, because SDLT is only payable upon completion of a purchase. When a property is bought off plan, there is a long period between the exchange of contracts (signing the SNP in Malaysian terms), and completions (when the entire purchase price has been paid). So if the oversea investor sells off the property before it is completed then it is left to the ultimate purchaser to complete the sale and pay the SDLT.

To assist you in calculating your SDLT, please go to the following link for the stamp duty calculator:

https://www.stampdutycalculator.org.uk/

Ria Apartments

Opening for bookings in Summer 2020.

Register now to receive updates

to avoid disappointment.

Ria Apartments is a Boutique Apartment which

consists of 3 Apartments.

Price: £430,000

Price: £280,000

Apartment 1: A 64 sqm ground floor 2 bedroom apartment with private entrance and garden.

This is a very unique apartment, because it has its own private entrance and garden. A private garden is highly sought after in London, as people like to have BBQs in their garden when it is nice and sunny, and or let their young children have some outside space to play.

|

| Apartment 1: 2 bed Ground Floor Private Entrance |

|

| Apartment 1: Open plan kitchen and living room, and work area |

|

| Apartment 1: Living room and entrance to garden area |

|

| Apartment 1: Bedroom 1 |

|

| Apartment 1: Bedroom 2 |

Price: £430,000

Apartment 2: A 40.5 sqm first floor 1 bedroom apartment with private balcony and shared entrance with Apartment 3

(More information and pictures coming soon)

Price: £280,000

Apartment 3: A 71 sqm split level 1st floor and second floor 2 bed apartment with private balcony and shared entrance with Apartment 2

(More information and pictures coming soon)

Price: £380,000

We are open for bookings in June 2020, so in order to avoid disappointment, please register your interest, if you would like to be kept updated about this project.

Wednesday, 29 April 2020

Introducing Ria Apartments, A Boutique Development in South Norwood, Croydon (South London)

Ria House is a boutique development in South Norwood, Croydon which consists of a block of 3 apartments

(2 x 2 beds, 1 x 1 bed) completing in Summer 2021.

The name Ria was chosen as the name of the building because development company belongs to a group of Malaysians, and we would like to put a permanent mark of Malaysia in London, hence a meaningful Malaysian name was chosen instead of an English name.

Location

South Norwood is located in London Travel Zone 4, in Croydon Council. This development is located less than 1 mile away from Norwood Junction Railway Station, and therefore is just 12-15 minute walk up a busy main road (Portland Road) towards the high street. From Norwood Junction Railway Station is just one stop (13 minutes travel time) to London Bridge, which means including time walking to the station, one can arrive in Central London within 30 minutes.

Ria House is located within the junction of Portland Road (main road) and Sandown Road (residential road). It is just a stone throw away from many amenities:

Red route showing the walk from Ria House to Norwood Junction train Station. There are many amenities just along this route, starting from the South Norwood Leisure Centre which is situated just opposite the flat. There is a swimming pool, gym, and sporting halls in it. Next to this is also Woodside Health Centre, South Norwood & Woodside Social Club. Just next to the Leisure Centre is a Tesco Express, and if you want another place to get groceries, you can just walk about 5 minutes up the road, you will see a Sainsbury's. There are also various shops along the way towards the train station, including a Post Office, and other independent shops selling meat and vegetables.

(2 x 2 beds, 1 x 1 bed) completing in Summer 2021.

|

| Ria House: 3 -Storey Corner Plot |

The name Ria was chosen as the name of the building because development company belongs to a group of Malaysians, and we would like to put a permanent mark of Malaysia in London, hence a meaningful Malaysian name was chosen instead of an English name.

Location

South Norwood is located in London Travel Zone 4, in Croydon Council. This development is located less than 1 mile away from Norwood Junction Railway Station, and therefore is just 12-15 minute walk up a busy main road (Portland Road) towards the high street. From Norwood Junction Railway Station is just one stop (13 minutes travel time) to London Bridge, which means including time walking to the station, one can arrive in Central London within 30 minutes.

Ria House is located within the junction of Portland Road (main road) and Sandown Road (residential road). It is just a stone throw away from many amenities:

|

| Location of Ria House from Norwood Junction Railway. |

Red route showing the walk from Ria House to Norwood Junction train Station. There are many amenities just along this route, starting from the South Norwood Leisure Centre which is situated just opposite the flat. There is a swimming pool, gym, and sporting halls in it. Next to this is also Woodside Health Centre, South Norwood & Woodside Social Club. Just next to the Leisure Centre is a Tesco Express, and if you want another place to get groceries, you can just walk about 5 minutes up the road, you will see a Sainsbury's. There are also various shops along the way towards the train station, including a Post Office, and other independent shops selling meat and vegetables.

On Sandown Road, if you walk down following the road, you will not miss the Oasis Academy Ryelands, an award-winning, 2-form entry, co-educational Nursery and primary schools on your right. If you continue your journey further down the road, you will see Oasis Academy Arena and Croydon Sports centre in the South Norwood Country Park

Monday, 27 April 2020

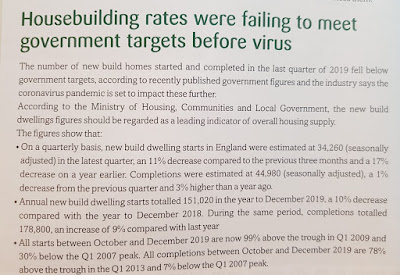

Latest UK Market News: Homebuilding rates were failing to meet government targets before the virus

|

| UK Market News, Property Investor News April 2020 |

As the UK Housing Crisis continues, the coronavirus pandemic is set to impact these further. The government needs 300,000 new homes every year, but they have failed to meet this target for many years. There is expected backlog of homes is now about 1 million, and unless something drastic happens in the home-building industry, it will take a very long time before the backlog can be fulfilled. Even if the homes built is doubled, that is just enough to meet the annual figures, not fulfilling the backlog.

This is good news for investors, as savvy investors will always buy invest in an industry that has a chronic short of supply and this issue with short supply is unlikely to be fixed in the short term.

Monday, 13 April 2020

How I started my career as a veterinarian in Malaysia but ended up as a full time portfolio landlady, investor, mentor and developer in the UK.

I graduated as a veterinarian from Universiti Putra

Malaysia in 2001. I practiced as a small animal veterinarian but as much as

I loved working in a veterinary hospital, the pay was low, and even at that

point I realized that freedom of time and opportunity to travel was something

that I values greatly. After 3 years, I hung my stethoscope, and took on a

role as a drug pusher in the livestock industry, where my role was to convince

farmers and feedmillers in South East Asia that if they include my company’s

products, their chickens and pigs would be healthier and therefore increasing

profits for the livestock producers.

|

| Photo above taken as a student veterinarian volunteering in a zoo |

In my early 30s, my then partner told me that his life plan was to work very hard on his business so that he could retire at the age of 45. That got me thinking as to what would be my retirement plan, as I realised, I could not rely on just my EPF as the amount would be insufficient for a decent lifestyle, taking into account the inflation in 30 years’ time. Plus I didn’t want to rely on my future children.

I then started researching on all the possible ways I could secure a decent retirement, and found out that property was the best way

because of the power of leveraging of your money. What does this mean? If you buy RM20,000 worth of gold bar, and if price of gold goes up by 10%, you make

RM 2,000. However, if you put RM20,000 as a 10% deposit for a RM200,000 house,

and the price increases by 10%, that means you would have made 20,000, which is

a 100% returns on your investment. Plus, throughout the mortgage term, the

tenant will be the one financing the mortgage, so that in 30 years time, the

property would worth at least double the value, the mortgage will be fully paid

off, so that will mean my initial investment of RM20,000 would now be worth

RM400,000!

So with that plan in mind, I started buying a few

properties, which was as many as I could based on my savings as well as

salary for mortgage.

In 2010, I met my husband and relocated to the UK to start

a family. A year later my son James was born.

As I was very curious about the real estate in the UK, I invested in a property course and learned that:

- There is a mortgage product called Buy to Let mortgages where you can get a home loan based on the rental income of that property, instead of your personal income.

- The strategy of buying below market value properties and then refinancing it later at full market value, and obtaining the capital that was invested back out, and then recycle the process.

- The importance of being able to recycle your cash!

Fortunately for me, the property prices in Malaysia have soared in that period, so between 2012-2015, I sold off my properties in

Malaysia and used the profits as deposits for my Buy To Lets., and then

re-mortgaging them every 2 years to extract capital from the property.

My first investment property in London. It was in Zone 5 East London, and I bought it for £163,000 (normal value £189,000), and rented it for £1,100 a month.

However in 2016, the property climate change with

introduction of new taxes rules, and a tightening on lending conditions meant

that the happy days of remortgaging every 2 years to buy another property was

no longer feasible.

I then started looking for other alternatives and went

into property development. I did a Joint Venture with another property developer to buy a corner pet fish

shop which was converted into 3 flats and was sold out on the fourth day. During

this time I also invested with another developer, and also have bought a site

in London to build a block of 3 units of apartments.

|

| My first development Joint Venture - a disused corner fish pet shop |

After conversion into 3 flats

Being a full time property investor/ developer/ portfolio

landlord, I have access to some very good investment deals, and because I am both a developer, as well as an investor, I am also able to do the numbers to

uncover good investment opportunities. As my own investment funds have been

committed to other projects, and it was a shame to let this opportunity go, I

started sharing this opportunity with friends who have money sitting in the

bank, but with no access to good deals, or no time or experience to identify

these opportunities, and to work in such a way that it would be a win-win

situation for everyone. I have always been passionate educating my friends

about leveraging their funds using property investment to achieve passive income

and financial freedom, because as Warren Buffet had said ‘If your money don’t

work for you when you sleep, you will have to work for money till the day you

die’.

So the purpose of this blog is to share my experience and knowledge to fellow Malaysians or any other property investors on Property Investment in the UK, so that you can learn about all the trends and the different investment opportunities here in UK that would suit your appetite for risk and returns.

Subscribe to:

Comments (Atom)